Creating a budget is one of the first things people learn to do when they start “adulting”. That is, if they want to stay on top of their growing list of bills, and still save money over time.

Most people think that creating a budget should be simple. You take your income, subtract your expenses, and whatever you have left you can spend however you like, right?

It really isn’t that simple. To do things right, you should use a budgeting app. The two most popular budget apps are You Need a Budget (YNAB) and Mint. This article will compare YNAB Vs Mint and help you decide which may be the better budget app for you.

Why Do I Need a Budget App?

A budget that’s too simple is a budget for people who never really want to get ahead. They won’t be prepared for emergencies, they won’t have a retirement, and they certainly won’t remember those bills that arrive unexpectedly.

The most important thing to keep in mind, whether you go with YNAB or Mint, is that neither one is going to create a budget for you. There will always be some up-front work to get started.

Getting Started: Mint

Mint actually does try to automate your budget creation process. It does this by having you provide it with all of the login details for all of your various accounts.

When you first sign up, Mint will take you through a wizard where you’ll add all your account login details. If you’ve already finished the wizard and want to add more accounts, you just select Add Accounts from the menu.

Once you’ve added all accounts, you’ll need to give Mint 24 hours or so to pull in all of your account details and attempt to sort everything out into somewhat of a budget.

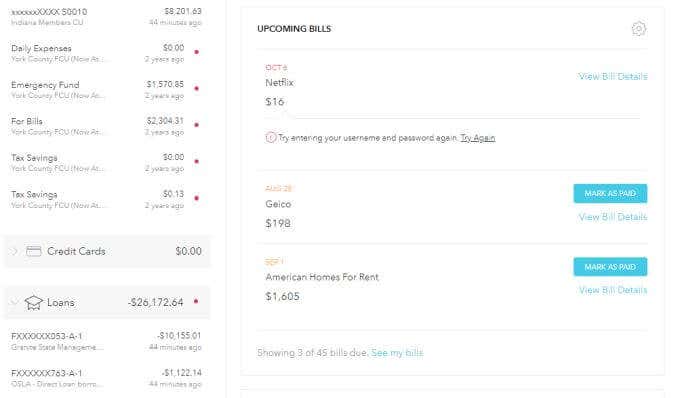

Once everything is set up, the next time you log into your dashboard you’ll see all of your accounts on a single page.

This includes:

- Checking and savings account balances

- Credit card balances

- Loan balances

- Investments and property holdings

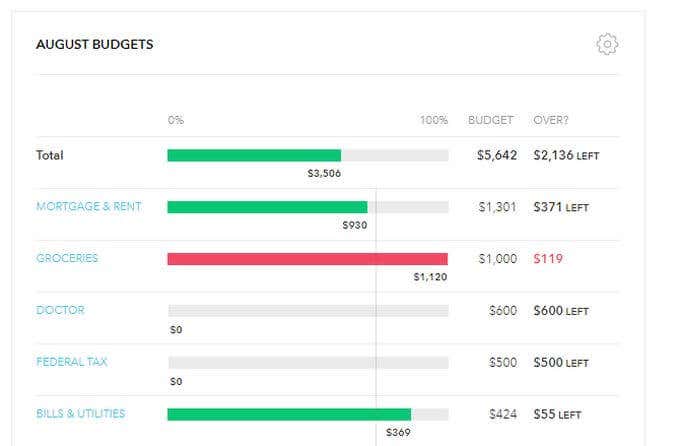

- A list of your upcoming bills and their dates

- Various charts detailing your spending patterns

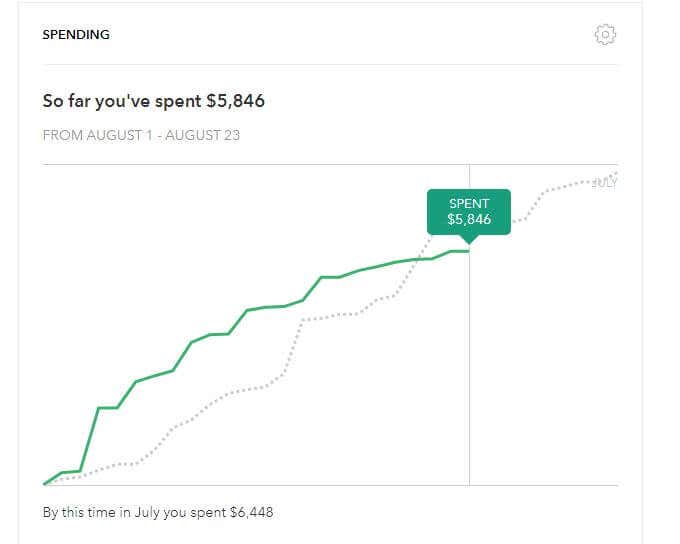

The entire “budgeting” approach of mint is historic data analysis. It helps you look at your spending patterns so that you can adjust your future spending to reduce the things you’re overspending on.

Mint knows all of your spending “goals” based on the budget you create. In the next section you’ll learn more about what “creating a budget” looks like in YNAB vs Mint.

Getting Started: YNAB

Getting started in YNAB is a lot different. This is mostly because the entire philosophy of YNAB is upside down from what you’d normally think about when you think of budgeting.

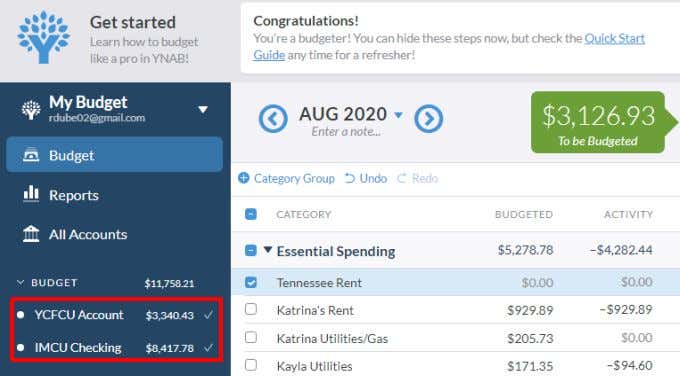

YNAB doesn’t care how much you earn or spend every month. It only cares how you plan to spend the money that you actually have in your account. Because of this, the only account information you need to provide are your bank accounts.

YNAB will connect to those accounts and pull in all balances.

When you first get started with YNAB, it will provide you with a default budget that matches most of the items in a typical household family budget.

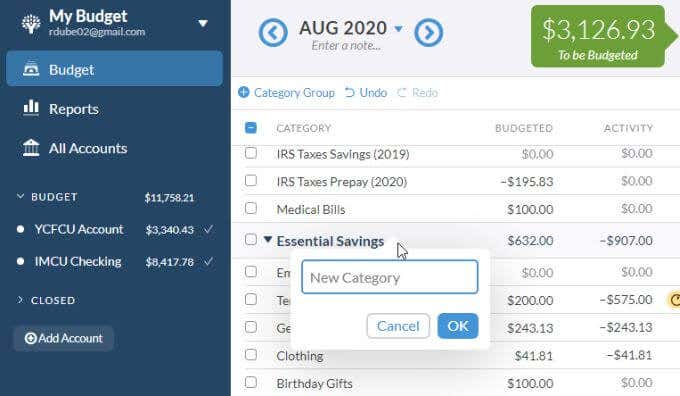

You can add new items by selecting the little + icon to the right of a section and add a new “Category” for each budget item.

At this point you don’t actually need to budget anything, you just need to try and make sure everything you ever expect to spend money on is included in the list.

Once you’ve included anything, it’s time to assign all available money in your bank accounts to various items in your “budget”. We’ll compare how you do this in YNAB vs Mint in the next section.

Making a Budget: Mint

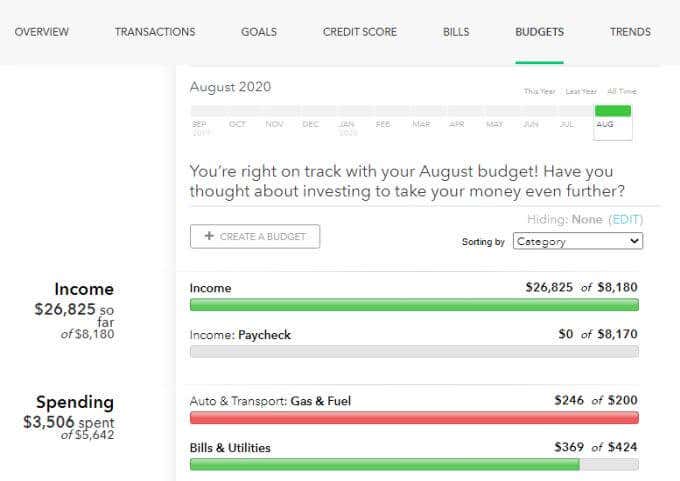

Mint is a bit old-school when it comes to budgeting. This is because it uses the standard approach of assigning a “goal” for each bill. Meaning, you assign it a monthly limit you want to keep it under.

To get started with creating a budget in Mint, select Budgets from the menu,

Next, select the Create a Budget button.

You’ll select each category (budget item) one at a time, assign the recurrence of that bill, and the maximum amount you want to spend (or have to spend) for that bill.

You’ll need to do this for every single budget item that you either have a bill for, want to save for, or investment you want to make.

This really is no different than a standard budget you might create in Excel. The only difference is that Mint brings in your actual spending patterns over time and then compares your actual spending with those budget spending goals.

What you’ll notice is that the end result of Mint is this:

- You’ll know when your overall spending is getting out of hand before the end of the month.

- You’ll see which budget items you’ve overspent on each month.

- Mint tends to induce a lot of guilt since overspending on budget items is often inevitable.

- Handling unexpected expenses in Mint is difficult and adds to your financial planning stress.

- The bill notification emails from Mint can get annoying if you don’t turn them off.

- Overall, the budgeting interface and process is complicated and time consuming.

Making a Budget: YNAB

Making a budget in YNAB is going to set your head spinning at first. This is especially the case if you’ve always used the old-school monthly budgeting approach.

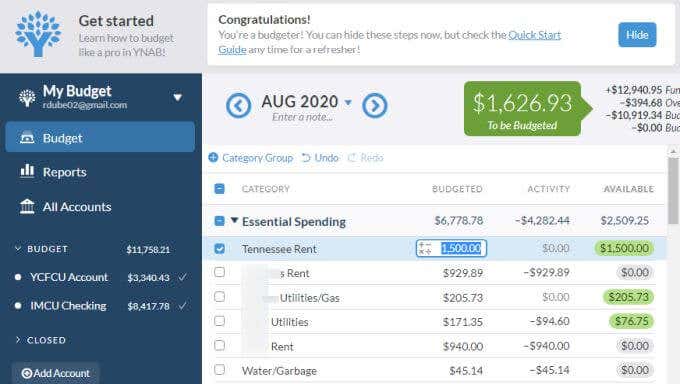

If you’re expecting to “assign” a monthly amount to each budget item at the start of the month, you’re going to have to relearn everything you’ve ever thought about making a budget.

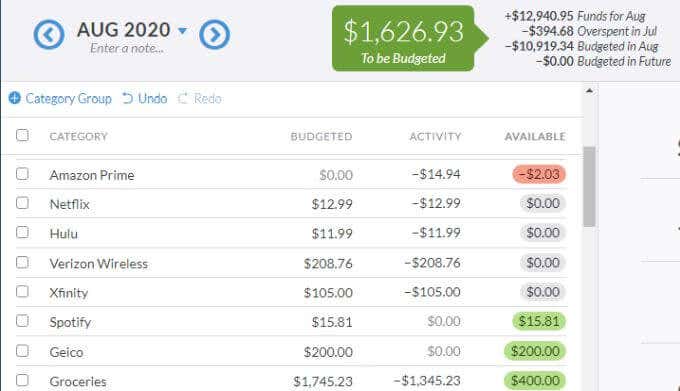

The YNAB approach is that you’ll only plan out your spending as far into the future as you can with the cash you currently have on hand. “To be Budgeted” gets loaded with more funds any time you receive a paycheck or any kind of positive cash flow into your bank account.

You’ll need to go down the list of your budget items and assign pieces of those “To be Budgeted” funds to each budget item that is due the soonest.

As you work down the list, you’ll need to make sure only to assign funds to those things where the due date is coming up the earliest.

Once your “To be Budgeted” amount is drained, you’re done until the next time you receive a paycheck.

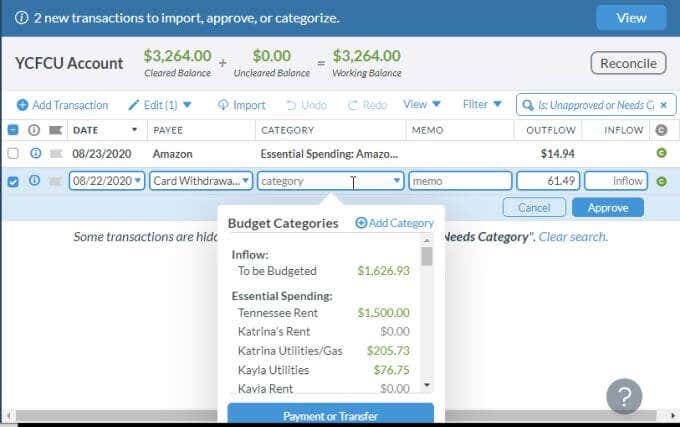

The other side of budgeting is assigning which categories your recent spending appears in. You’ll need to do this nearly every time you log into YNAB by selecting each bank account and assigning which category each item belongs in.

Over time, as you assign your spending activities, you’ll see that activity subtracted from the amount that you budgeted for those.

This is where YNAB gets very interesting. If you overspend in a category, you’ll see that in red. You’ll actually need to cover this overspending by either assigning more “To be Budgeted” money to it (if you have any left), or reassigning funds from other budgeted categories.

What you’ll notice is that the end result of YNAB is this:

- It forces you to control spending in your categories (like dining out) so that you don’t have to “steal” money from other categories that are important to you (like saving for a car).

- Assigning incoming funds to budget categories feels like you’re actually spending that money, which forces you to be more realistic about your spending.

- YNAB helps you build savings in different categories of your budget, and promotes pride when you actually accomplish that.

- Not having imported due dates for bills forces you to track due dates in another system, so that you assign your available funds to the most critical bills first.

- The underlying psychology of YNAB budgeting makes accumulating funds in your bank accounts come naturally.

YNAB Vs Mint: Overall Comparison

So when comparing YNAB vs Mint, which one wins? In this case, there’s actually a very clear winner.

Mint is built upon the old fashioned concept of making a monthly budget, setting goals, and then beating yourself into submission with guilt as you fail every month.

Mint does have the benefit of being integrated with every single bank account and company that you have bills with, but with that integration comes an enormous security risk. Should anyone ever hack Mint servers, every single one of your financial accounts are vulnerable.

YNAB, on the other hand, uses a very innovative approach. It literally makes you plan out all incoming funds the moment you receive them. If you want to save money, you need to make sure all bills that are due before your next paycheck have money assigned to them before you set aside money for savings.

The benefit to this is that you’re no longer looking at your bank account to decide if you can afford something. You’re looking at your budget. If you haven’t allocated money for that brand new couch, you’re going to have to steam money from something else that may be equally important to you.

That is the secret behind why YNAB works so well, and why it’s clearly the winner over Mint, hands down.