Paypal is known as a safer alternative to credit cards when it comes to paying for things. However, it’s also a great way to receive money, especially when you need to receive money from someone in another country, where a bank wire transfer would be expensive and take far too long. If you have a PayPal account and want to know how to receive money, here are the primary methods.

Receiving Money via Email Address

Any PayPal user can send money to an email address. PayPal will credit the account associated with that email address with the amount sent. Interestingly, the person doesn’t have to have a PayPal account yet.

If they don’t have one, they’ll receive an email saying that they’ve been sent money. Now, the recipient needs to open a PayPal account and set it up. The balance will then be available.

Sending Someone a Paypal.me Link

At some point, PayPal figured out that not everyone is cool with sending their email addresses to strangers to receive money. After all, our email addresses open us up to spam, scams, and other unpleasantness.

This is why they added the Paypal.me link. It is a unique link that lets anyone who clicks on it send to money to your Paypal account. Setting up a PayPal.me link is easy:

- Select the Create Your PayPal.Me link.

- Log in to your PayPal account or create one if necessary.

- You’ll be issued a unique link.

Once you’ve got your unique link, receiving money is as easy as copying the text and sending it to someone via any method you like. Just remember that you need to communicate the amount to the person outside of PayPal.

PayPal.me links are also helpful for setting up an easy donation method. For example, you could add the link to your Twitter profile so that followers and fans can quickly drop you a few bucks.

Using the Request Function to Receive Money

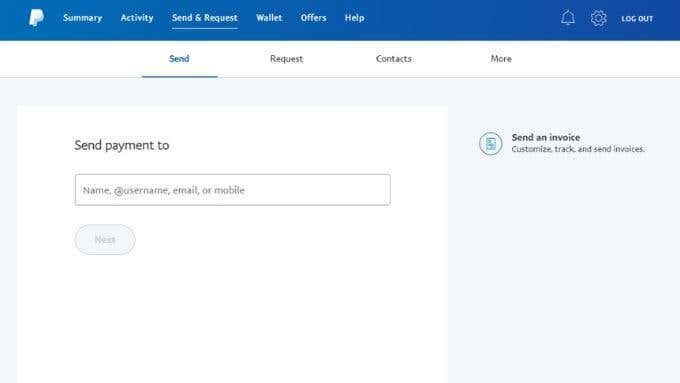

You can request money from within your PayPal page or app. We’re going to use the website here, but the steps within the app are the same.

- Log in to PayPal.

- Select Send and Request.

- Switch to the Request tab.

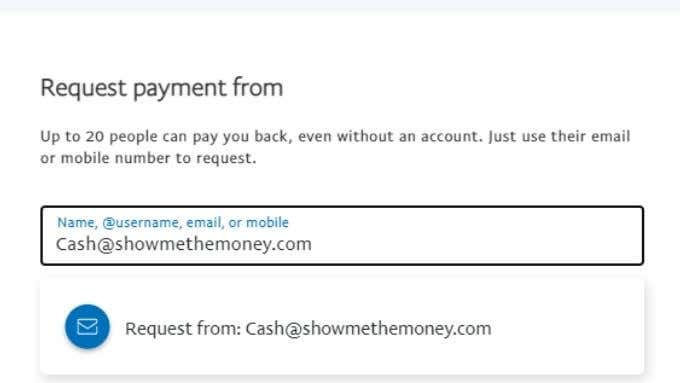

- Type the name, email address, or mobile number of the person you want to request money from.

- Confirm the contact information and select Next.

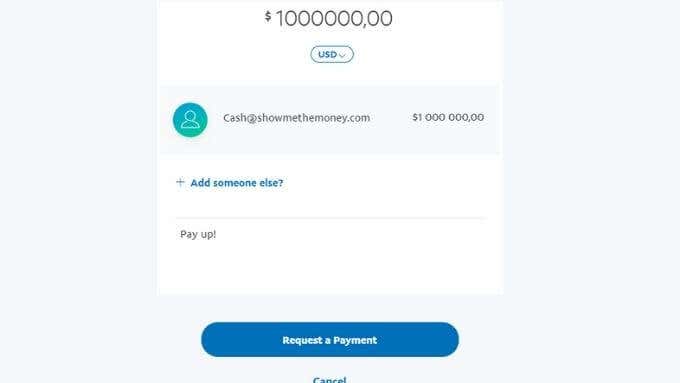

- Enter the amount you want to request.

- Add an explanatory note if applicable.

- Select the Request a Payment button.

You’ll get an email summarizing the payment request’s details. The person or entity will receive a similar message and can then simply follow an included link to pay you.

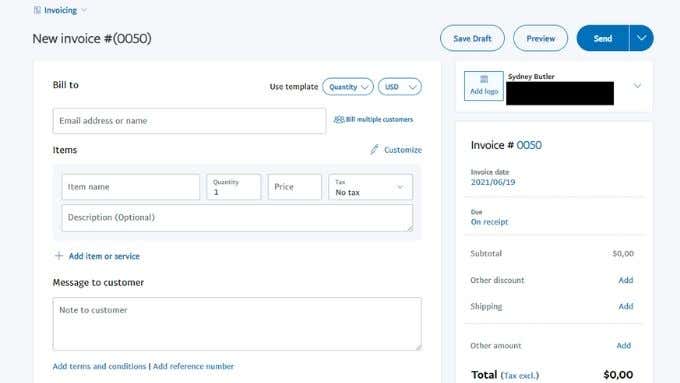

Requesting Money With an Invoice

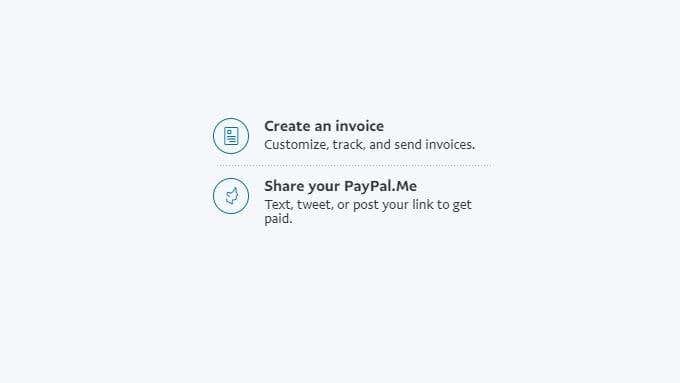

While sending money between friends or family is perfectly fine using the standard money request method, you may have to submit an invoice if you’re trying to get paid for work or a product sold. The good news is that PayPal has a robust built-in invoicing system. So you don’t have to use separate software to make, maintain or send invoices.

- Log in to PayPal.

- Under the Request tab, select Create an Invoice.

- Complete the invoice form with your relevant information.

- Once you’re happy with the invoice, select the Send button, and PayPal sends it to the recipients you’ve specified.

You’ll also get an email letting you know that you’ve sent an invoice. You can also resend the invoice as a reminder.

PayPal Balances and Bank Transfers

Once you have an available balance in your PayPal account, you need to find a way to use that money. Most online merchants accept PayPal, so if you want to spend your money with a merchant, you don’t need to do anything further.

However, if you want your money in a general bank account, you need to link an eligible account. You can do this by selecting Link a Bank under Wallet and then providing PayPal with your banking details. If it clears, you can transfer your PayPal balance to your local bank account using the Withdraw function.

If you didn’t know, you don’t have to have a PayPal balance to buy stuff online. PayPal will bill the payment method (such as a credit card) you have and act as the secure intermediary. So don’t feel obligated to leave money in your PayPal Balance.

Paypal Alternatives

While PayPal is one of the largest and most trusted services for moving money online, especially across borders, there are several other options. Looking for an alternative is sensible if PayPal doesn’t operate in your country. You may also get lower fees from other services, depending on where you are in the world.

Venmo is owned by PayPal and has become one of the most popular “social payment” apps available today. Venmo is perfect when you and your friends want to split restaurant bills or otherwise pass money around without using cash.

Payoneer is another good global solution. You can order a card to make online purchases from your Payoneer balance. Also, you can receive money through one of several international bank account numbers and directly from other Payoneer accounts.

Finally, Skrill is another alternative to PayPal. The main drawback is that it isn’t as widely accepted as PayPal, but if all you’re looking for is a way to receive money and move it to your bank account, it should be on your shortlist.